Photo above: Kelly Sikkma from Unsplash

There’s a lot of confusion around free Federal and State tax services for 2019. Hopefully, the following will help clear up the confusion.

A majority of this article is taken from ProPublica. “ProPublica is a nonprofit newsroom that investigates abuses of power.”

I’ve relied on reports from ProPublica for some time now due to their investigative journalism. They do the research and report on it so you don’t have to.

In the past, there have been a few tax companies who advertise free services but will send you to their services that aren’t free. It’s time-consuming checking to ensure you’re filing in the appropriate “free tax service”. And many of these tax services are aware of the stress of taxes. This stress can be caused by a number of things: lack of time, lack of funds, or complex situations, therefore, it may lead you to click on the wrong links when the site language is misleading.

Here’s an article by ProPublica on Intuit (TurboTax) and how they use “dark patterns” to steer tax filers from their free services to paid.

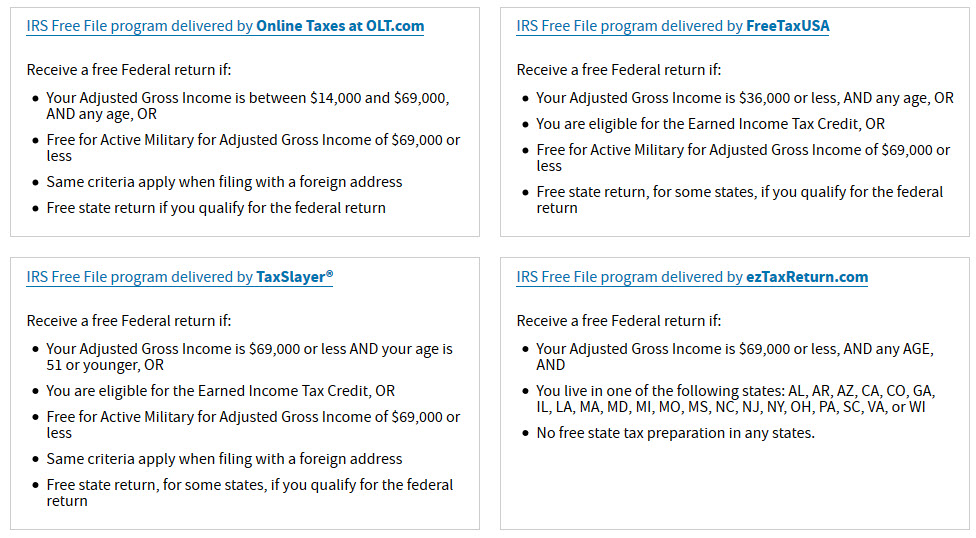

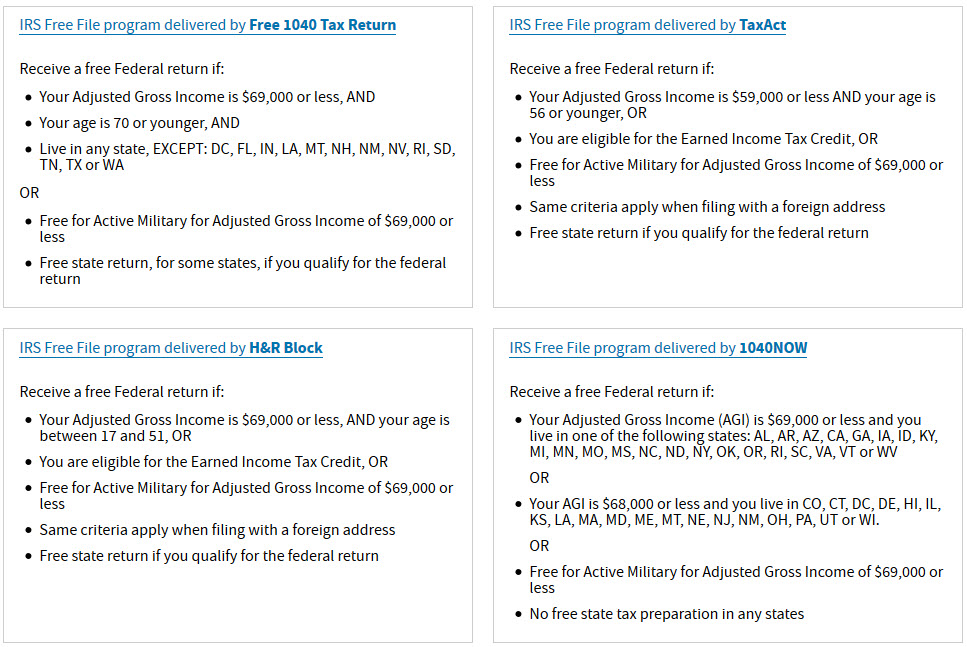

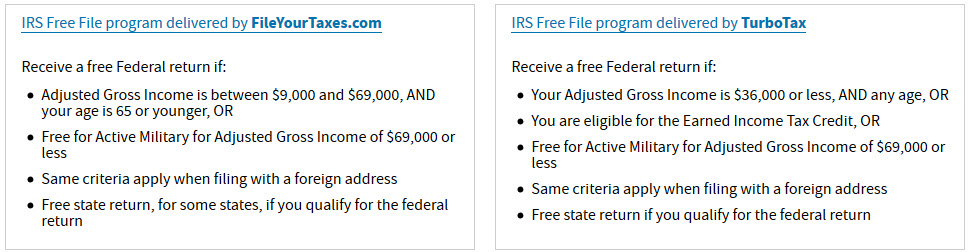

If you make less than $69,000 a year, you can find free tax filing options at the IRS Free File webpage. Or if you want you can use their free file lookup tool to help you decide.

If you make more than $69,000 a year, there may be free options available to you offered by several commercial tax prep companies. But, it’s best to double-check what forms you will use and then if the free service accepts them. Not all forms will fall into the free category.

Good news for Independent Contractors is that some of the free services accept 1099. The only one that has a simple and clear list is H&R Block (see below). TaxAct and TurboTax are also available. CreditKarma is available too but they will try to use your data to target you with advertising. Go to the ProPublica site to get links and for more information if you fall in the $69k + category.

Commercial tax companies will still try to get you to pay depending on the forms you use. It might be helpful to contact a tax expert if you feel filing your taxes falls into the free category. Also, your local library might be able to direct you to free tax expert help.

If you’re in the military, you can use MilTax, a service provided by the Department of Defense that uses a version of H&R Block’s tax software.

You can qualify for the IRS’ Volunteer Income Tax Assistance (VITA) program if you:

- Make less than around $56,000 a year, OR

- Live with a disability, OR

- Speak limited English

The program matches you with IRS-certified volunteers across the country who can help with free basic income tax preparation and electronic filing. You can use the Volunteer Income Tax Assistance locator tool or call 800-906-9887 to find someone to help you.

Along with VITA if you are over the age of 60 the IRS has a tool to help find free tax assistance in your area under the TCE (Tax Counseling for the Elderly) program.

Check out ProPublica for more information.

The staff at Cheap Finds New Orleans are not tax experts and won’t be able to answer any tax related question. Hopefully, some of the links we provided can help alleviate some of the stress though.

And if you need further information about taxes and have questions the site Balance is easy-to-read and has a user-friendly design. A lot of their writing staff are Certified Financial Planners.

Best of luck!